Erasmus Institute of Technology has partnered with WeMakeScholars to offer a tuition fee waiver to ten selected Indian students. This scholarship can be availed for the collaborative programs between EIT Innoenergy and multiple European universities including- KTH Royal Institute of Technology, TU/e Eindhoven University of Technology, KU Leuven, Ecole Polytechnique, Esade Business School, Universitat Politecnica de Catalunya UPC, Aalto University, Instituto Superior Tecnico (IST), Politecnico di Torino, AGH University of Science and Technology, Grenoble INP- Insitute of Technology, University of Paris-Saclay, UnternehmerTUM, PSL Research University, Ecole des Ponts ParisTech (ENPC).

Value: Each student will receive 10,000 Euros (5000 Euro for each year of study).

This opportunity is available to students who meet the following eligibility criteria:

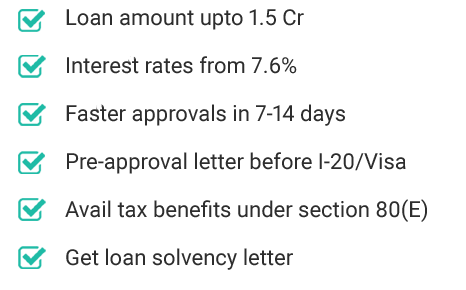

WeMakeScholars (WMS) is an organisation supported by the IT Ministry, Govt of India with a motive to offer unbiased education loan support to aspirants. There is no charge incurred for this initiative as it is under the Digital India campaign. We are associated with 14+ banks (public/pvt) in India and help you get the best education loan matching your profile.

As of now, we have processed 3000+ applications of which 70%+ students got sanctioned. In case students have issues with the property documents, interest rate, processing time etc., the team will assist them end-to-end and guidance to find solutions.

WeMakeScholars is recognized as the top social impact initiative by Amitabh Kant, CEO of the NITI Aayog, Digital India along with Sam Pitroda, Former Advisor to the Prime Minister. (January 2016)

WeMakeScholars signing a MoU with Prof. Anil D. Sahasrabudhe, Chairman, AICTE (All India Council for Technical Education), Govt. of India to spread awareness on higher education in Indian colleges. (October 2017)

Best customer support and service:

The WeMakeScholars team can offer you end to end support during and after your education loan processing. The financial officer can guide you and save much time and money for both you and your parents.

Better Negotiations for you:

Our team can guarantee you the best ROI and also makes sure that you'll be charged nominal during the legal and valuation reports.

Multicity cases processing:

If you are a permanent resident of a city A and if the property is in a different city B, then in such cases, the branches take a lot of time to issue sanctions. Applying through WeMakeScholars makes the process pretty simpler.

Cashback offered:

You will be rewarded with a cashback on multiple disbursements to a maximium of INR 3000, as you are supporting the Digital India campaign by applying for your study abroad education loan via WeMakeScholars.

Better Interest rate:

It is always better to apply via WeMakeScholars than going directly to the private banks and NBFCs. This is because, you will be eligible to get lower interest rates with atleast 0.5% reduction, when compared to applying to them directly.

Best customer service with end-to-end coordination:

In the education loan, negotiation plays a vital role. Lenders can reject your case without any proper explanation too. In all these situations, the WeMakeScholars team can assist you in all the ways to get the loan sanction as WMS is directly associated with the Head office of all the banks and NBFCs.

Approval of deviations:

Many a time, deviations are to be taken for cases to get it sanctioned. Like if the GRE score is lesser than the bank's minimum requirement etc. WMS tean cab assist with upto 45 lacs. The rate of interest will depend on 3 parameters icluding the student's profile, co-applicant profile and the university student is going to. The rate of interest ranges between 10.9%-13.9%.

Cashback offered:

You will be rewarded with a cashback on multiple disbursements to a maximium of INR 3000, as you are supporting the Digital India campaign by applying for your study abroad education loan via WeMakeScholars.

Irrespective of the bank, you get referral reward of upto ₹3000 for every successful referral. Now, you have a reason to share with friends too. Refer now!

Kindly login to comment and ask your questions about Scholarships & Education Loans